Neue Mobilitätsansätze für Autohändler zur Reduzierung der Komplexität und Abdeckung der Kundenbedürfnisse

The Institut für Automobilwirtschaft (IfA) and Deutsche Automobil Treuhand (DAT) presented the "Top 100 Car Dealership Groups in Germany" study (see Autohaus publication Autohaus

vom 19.10.23), aus der hervorgeht, dass die größten Gruppen für fast ein Drittel der Neuzulassungen verantwortlich sind. Trotz dieser beeindruckenden Zahlen stehen die Autohändlergruppen aufgrund der veränderten Mobilitätsbedürfnisse der Kunden und der sich wandelnden Beziehungen zu den OEMs vor erheblichen zukünftigen Herausforderungen. Die intelligente Kombination von Miet- und Abo-Modellen könnte zusätzliche, unabhängige Einnahmequellen erschließen und gleichzeitig die Komplexitätskosten reduzieren, um den neuen Kundenanforderungen besser gerecht zu werden.

Zentrale Herausforderungen für Autohändlergruppen

Schwächung der Kundenbeziehungen

Autohandelsgruppen verlieren Kundenbeziehungen an OEMs und Online-Anbieter. Die Zunahme von Direktvertriebs- und Vertretungsmodellen der OEMs untergräbt die Preisgestaltungshoheit der Autohändler und schränkt den Zugang zu jüngeren Gebrauchtwagen ein, der für eine wettbewerbsfähige Bestandsverwaltung entscheidend ist

Transition to direct-to-consumer models

Moderne Kunden suchen flexible Mobilitätslösungen, die über den traditionellen Kauf und das Leasing hinausgehen. Auto-Abonnements und Mietmodelle sind auf dem Vormarsch, werden aber von den traditionellen Finanzierungsinstrumenten der Autohändler nicht abgedeckt. Dieser Wandel bedroht das traditionelle Autohändlermodell, das auf physischer Infrastruktur und persönlichen Kontakten beruht

Fragmentation of Systems

Der Einsatz unterschiedlicher teils von den OEMs vorgegebener Systeme für Kunden- und Fahrzeugverwaltung (DMS), Werkstattplanung, Vermietung und Abonnement und Buchhaltung führt zu Ineffizienzen. Diese Fragmentierung erschwert das Plattform- und Standortübergreifende Daten- und Prozessmanagement. Mehrmarken- Autohändlernetze müssen sich mit zahlreichen proprietären und von OEMs vorgeschriebenen Systemen auseinandersetzen.

Neue Wege durch Shared Mobility Lösungen

Höhere Auslastung und Flexibilität der Flotte

Ein kombiniertes Miet- und Abonnementmodell erhöht die Flottenauslastung, indem es flexiblere Nutzungsmöglichkeiten bietet. Insbesondere das „Generieren“ von Gebrauchtwagen aber auch die Anschluss-Nutzung von Rückläufern bekommt mehr und mehr Relevanz unter den veränderten Marktgegebenheiten. Diese Flexibilität reduziert Standzeiten und sorgt für einen insgesamt höheren Ertrag für den Autohändler. Kunden können je nach Bedarf zwischen Miet- und Abonnementplänen wechseln, was die Zufriedenheit und Loyalität steigert.

Data-Driven Insights

Durch umfassende Datenanalysen können Händlergruppen wertvolle Einblicke in die Produktnachfrage und Kundenpräferenzen gewinnen. Diese Informationen können zu fundierteren Entscheidungen und strategischer Planung beitragen.

Integrierte Systeme für betriebliche Effizienz

Die Implementierung eines integrierten Systems, das alle Formen der geteilten Mobilität abdeckt und DMS, Werkstattplanung, sowie Buchhaltung und weitere Systeme integriert, kann die Herausforderungen der Systemfragmentierung überwinden. Diese Integration vereinfacht das Datenmanagement, strafft die Abläufe und verbessert die Gesamteffizienz.

Embracing Innovation for Competitive Advantage

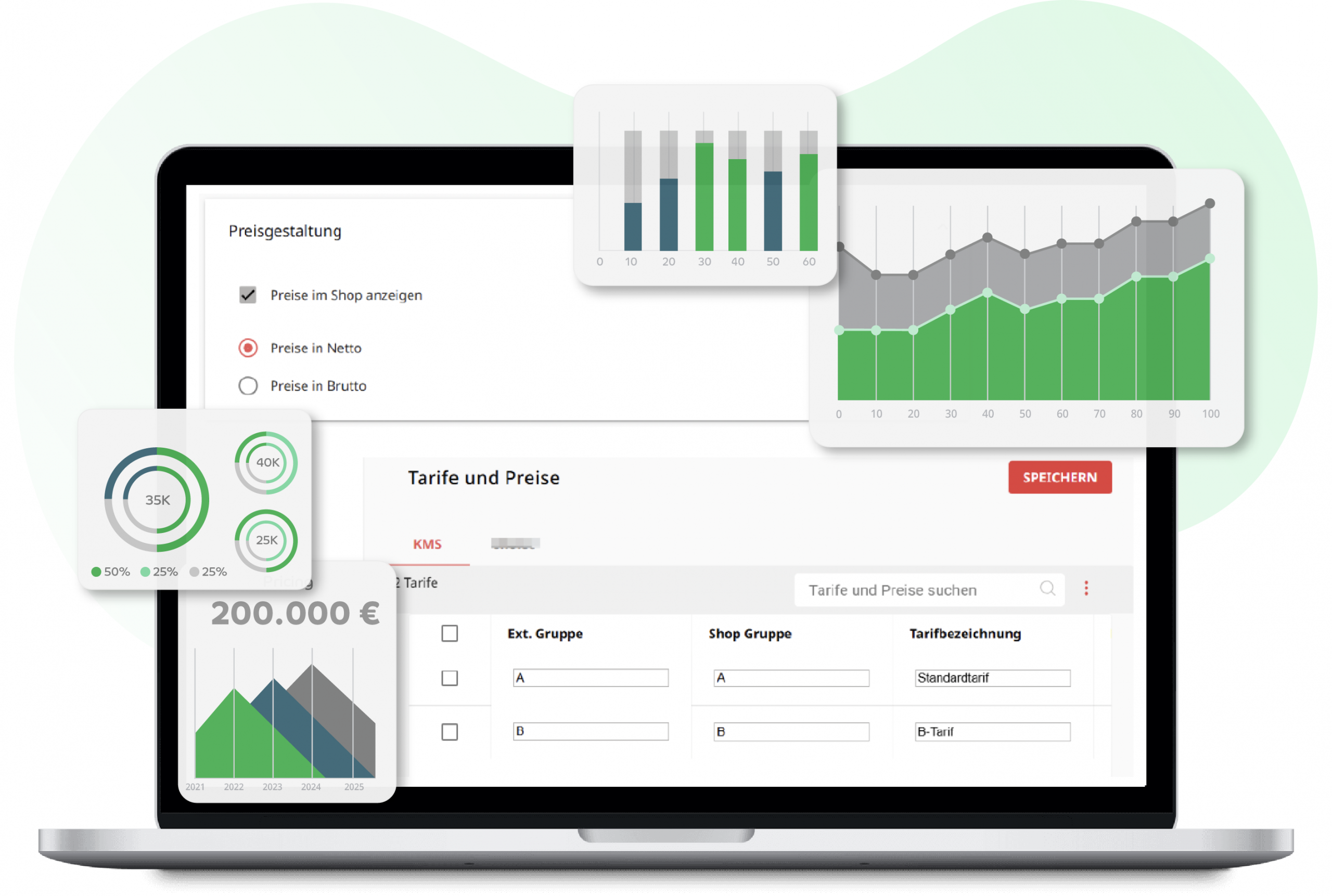

How do Car dealership groups benefit from One-OS?

One-OS bietet eine Vielzahl an speziell für Autohandelsgruppen relevanten Funktionen in einer einfach zu bedienenden, skalierbaren White-Label Lösung. Dazu gehören z.B.:

- Unterstützung einer (de)zentralen Struktur sowohl von Multi-Marken als auch Single Marken Unternehmen

– Stationen, User, Rollen & Rechte

– Zentrale und dezentrale Kunden

– Zentrale und dezentrale Tarife

– Zentrale und dezentrale Nummernkreise und Abrechnung

- Stationsbasierte Angebote oder Zustellung für Abo

- Zentrale White Label Buchungswebseite für Rent und Abo

- Online payment, verification and credit check (B2C)

- Optional integration of third-party vehicles in your own shop or partner shops

Abschließend erfordert die Bewältigung der Herausforderungen von Autohandelsgruppen innovative Lösungen wie moderne Autovermietungsdienste, flexible Eigentumsmodelle und fortschrittliche Händlerverwaltungssysteme. Durch die Fokussierung auf die Digitalisierung des Automobilsektors und die Nutzung von IT-Lösungen für Autohändler können Händlergruppen ihre Betriebseffizienz steigern und in der sich wandelnden Mobilitätswirtschaft wettbewerbsfähig bleiben.