Autor: Stephan Siehl - General Manager/ CEO at KMS Mobility Solutions GmbH

Date of Publication: March 20, 2025

1. Car purchases via OEMs and online platforms

Direct sales by manufacturers (OEMs) and online car sales are becoming increasingly important, even though traditional dealers continue to dominate. Key figures:

- Online purchases by customers: According to a 2023 study, 22% of car buyers surveyed in Germany have already purchased a vehicle completely online at least once . This represents a sharp increase compared to 2020 (+144%). Despite this growth, the majority still prefer to buy at a dealership, especially among younger customers.

- Sales via online platforms: In 2019, almost a third of German car dealers (29%) already reported selling vehicles via third-party online platforms . A further 28% used joint online shops with manufacturers, and ~21% even operated their own online shops . This shows that online channels were already part of dealers' sales mix years ago.

- Direct sales by the manufacturer (Agency model): More and more OEMs are focusing on the agency model, in which the manufacturer sells the car directly to the customer and the dealer acts as an intermediary. For example, the volume brands of the VW Group (VW, Audi, Skoda, Seat/Cupra; together approx. 37% market share) have started to offer at least their electric cars under the agency model. Mercedes-Benz even switched completely to direct sales in 2023. The proportion of new cars sold directly by the OEM (instead of by dealers on their own account) is thus increasing significantly - although this currently primarily concerns electric vehicles, this sales channel will continue to gain in importance as the proportion of electric vehicles increases.

Conclusion: Digital vehicle sales are growing rapidly. Manufacturers are increasingly selling directly (especially for electric cars), and online platforms are making it easier for customers to buy a car at the click of a button. Traditional dealers remain important, but are integrating digital channels in order to remain competitive.

2. Decline in margins in traditional retail due to the agency model

The agency model has noticeably reduced dealer margins. Instead of the previous dealer margin, the dealer now receives a commission set by the manufacturer, which is clearly noticeable in percentage points:

- Decrease in margin: in traditional contract models, a dealer's gross margin on new cars was around ~15% of the vehicle price. In the agency model, the remuneration typically drops to only 5-7% . This transition means a margin loss of around 8-10 percentage points for the dealer. In practice, a dealer therefore receives less than half the previous margin per new car sold.

- Take Volkswagen, for example: VW used to pay its dealers a basic margin of around 10%; under the agency model, the commission is now only 4-7%. Similarly, dealers of other brands report significantly lower profit margins. Industry experts describe this level of commission as ‘far too low’, as experience shows that a dealership needs a margin of around 8% to cover its costs. Anything above that would be actual profit.

- Background: OEMs expect the agency model to save on sales and marketing costs (approx. 30 % of vehicle costs are attributable to sales). They hope for higher net profits through standardized prices and direct customer data. For dealers, however, the model means the loss of former negotiating leeway and additional margins. The fixed commission is ‘several percentage points lower’ than the old margin, which increases the economic pressure on car dealerships.

Conclusion: The agency model significantly reduces dealers' revenues. Studies put the decline in dealer margins at around 50-70% of the previous level (e.g. from ~15% to 5-7% of the vehicle price). Many dealers are critical of this development, as their cost structure was based on the old margins and the agency model significantly reduces profits.

3. Decline in workshop and spare parts sales due to electromobility

Electromobility noticeably reduces the need for vehicle maintenance - which has a direct impact on aftersales sales (workshop and spare parts). Current studies are forecasting significant declines in this area:

- Deloitte forecast 2035: A highly regarded long-term study by Deloitte (‘Future of Sales and Aftersales’) expects serious losses by 2035. Assuming an e-vehicle share of ~40% of new vehicles, the aftermarket is threatened with a 55% drop in sales. According to the study, profits in service and parts would even halve. For an average car manufacturer in the German market, this would mean a slump in aftersales revenue of around 84% - a dramatic decline. The highly profitable spare parts business in particular would shrink by around 50 %, as electric cars require significantly fewer wearing parts than combustion engines.

- Roland Berger/CLEPA study: A joint study by Roland Berger and the supplier association CLEPA (presented in 2022) provides somewhat more moderate figures. According to this study, battery electric vehicles require around 30% fewer spare parts than conventional cars. Even in a scenario with a slower e-transition, spare parts sales are expected to fall by around 13-17% by 2040 . Workshop capacity utilization will also fall accordingly. Independent garages, for example, could have around 12% fewer businesses by 2030 and over 25% fewer in the long term (by 2040) if e-mobility becomes widespread (according to the 2040 service market study).

- Low-maintenance electric vehicles: The technical reason for these losses is simple: an electric car has no oil changes, fewer moving parts in the drivetrain and less brake wear (due to recuperation). Many routine tasks are no longer necessary and intervals are extended. Manufacturer analyses already show that maintenance and repair costs for electric vehicles are significantly lower than those of combustion engines.

Conclusion: Aftersales turnover (workshop service and spare parts) is facing a decline, driven by the higher proportion of low-maintenance electric cars. Estimates range from double-digit percentage losses in conservative scenarios to a possible slump of half or more by the mid-2030s if e-vehicles become widely accepted. The industry must adapt to this, e.g. through new service concepts or business areas, in order to compensate for these sales gaps.

4. Growth of car subscriptions and flexible mobility solutions

Car subscriptions (‘Auto-Abos’) and flexible mobility services are experiencing very dynamic growth in Germany. They are establishing themselves as an alternative to purchasing and leasing, particularly against the backdrop of changing customer demands for flexibility. Relevant market data:

- Current market size: In 2022, around 63,000 new car subscription contracts were signed in Germany. This was an increase compared to 2021 (approx. +4,500 contracts) and corresponded to 6.6% of new private registrations (2021: 5.3% market share). Experts expect around 100,000 new subscriptions in 2023, which would mean a market share of around 10% in the private segment. This growth (≈ +59% compared to 2022) underlines the trend.

- Annual growth rates: The subscription market has seen double-digit growth in recent years. In 2020, the number of current car subscriptions was still ~40,000; in 2021 already just under 60,000, in 2022 over 60,000 . Although there was only slight growth in 2022 due to supply bottlenecks (+7%), a big jump is expected again in 2023 . A study by the CAR Institute puts growth in 2022 at +50% (mainly due to private customers) . In the medium term, consultancies expect annual growth rates of 30-40 %.

- Forecasts up to 2030: Various industry sources predict that car subscriptions will make up a substantial part of the market in the coming years. According to an analysis by Prof. Helena Wisbert (CAR Institute), around 500,000 car subscription contracts per year could be concluded in Germany by 2030 - which would even put the subscription model ahead of traditional leasing in the private market. Other estimates go even further: in an interview, Wisbert even considers up to ~1 million active car subscriptions possible by 2030. For comparison: according to BCG, around 15% of new cars in 2030 will be car subscriptions (equivalent to ~450-500 thousand per year in Germany). These forecasts illustrate the enormous growth potential.

- Market volume: According to international reports, the global market volume for car subscriptions was around USD 5-6 billion in 2022 and will grow at a CAGR of >30% until 2030. There are similar trends for Germany; exact sales volumes are still low (estimated at <€1 billion in 2022), but are rising sharply.

Conclusion: car subscriptions are booming. In Germany, the number of subscriptions has risen from almost zero to around 60,000+ in just a few years, with a strong upward trend. Experts expect double-digit growth to continue: by 2030, half a million to one million vehicles could be on the road with a subscription. Car subscriptions and comparable flexible mobility solutions (short-term leasing, monthly cancelable flat rates, etc.) are thus establishing themselves as a permanent fixture in the mobility mix, especially among customers who value maximum flexibility and all-round carefree packages.

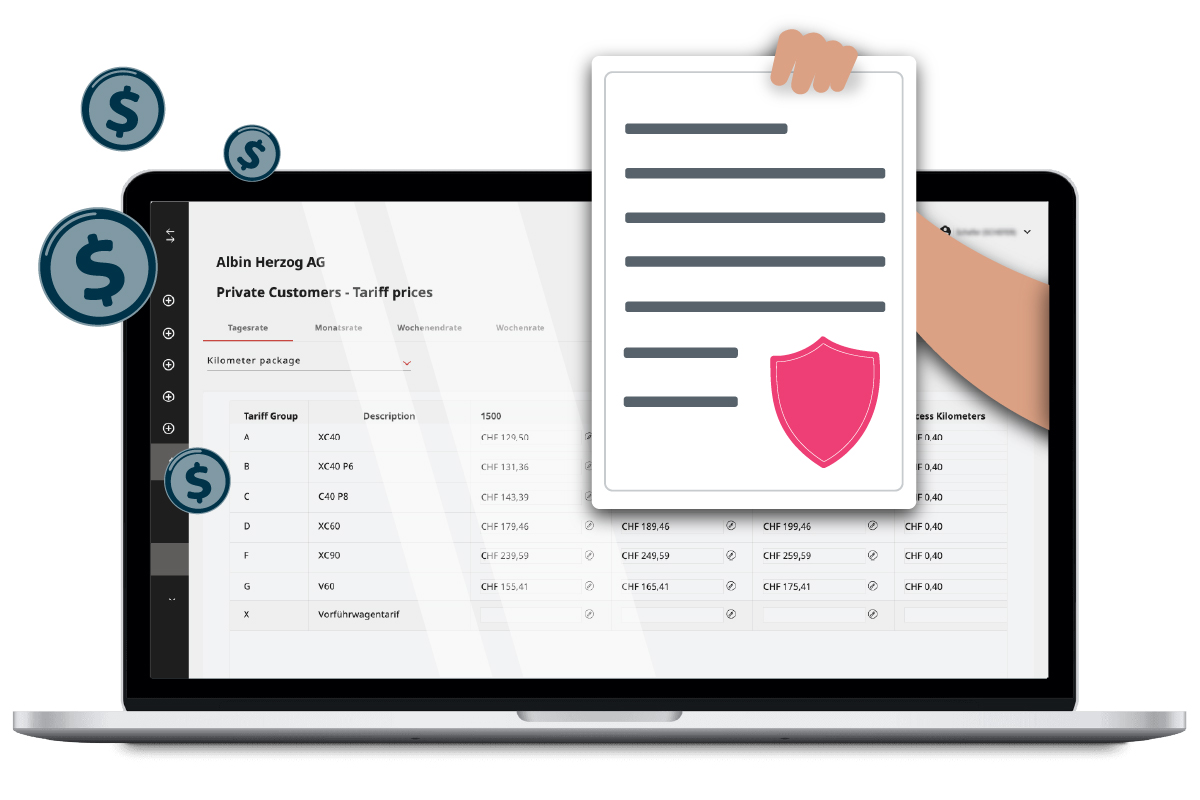

5. Higher gross profit per vehicle through own subscription platform (dealer perspective)

For car dealerships, offering their own car subscription service can bring significant revenue benefits per vehicle. Temporary rental on a subscription basis generates ongoing income for the dealer, while the loss in value of the vehicle is often less than the subscription revenue generated. Studies and practical examples show that the gross profit per vehicle can be increased in this way:

- Earnings can be doubled: the start-up ViveLaCar, which offers car subscription platforms to dealers, has calculated that “depending on the model and subscription term, a doubling of earnings is possible” compared to immediate sales . The background to this is that in the current market situation (high used car prices, shortage of vehicles), the loss in value of a vehicle during the subscription period is very low, but the subscription income provides additional margin potential. Dealers therefore “hold” the vehicle a little longer and skim off revenue before selling it.

- Example calculation Hyundai i30: A dealer could have sold a 1 year old1-year-old Hyundai i30 (10,000 km) in May at a sales price of ~€16,450, with a gross profit of around €3,150. Instead, he put the car on subscription until September and generated €1,968 in subscription proceeds during this time. The sales price in September fell only slightly to €15,650 (depreciation of €800). All in all, the dealer made €1,168 more than if he had sold the car immediately. If he had kept the vehicle on subscription until Feb. 2022, subscription income would have amounted to €3,936; with a sales price of €14,850, this would have resulted in an additional profit of €2,336 (compared to the sale in May). This example shows how the subscription income can more than compensate for the loss in value.

- VW Golf calculation example: ViveLaCar makes a similar calculation for a used VW Golf VII (worth €19,700): the usual gross profit for a direct salewould be ~€3,000 for the dealer. If the Golf were to run on subscription for 6 months instead (approx. 4,800 km use), the market price would fall to €18,800. The achievable income from the later sale would then only be ~€2,100 (lower margin due to depreciation). Together with the subscription income, however, the total revenue rises to €4,014 - i.e. around +34% higher than the original gross profit. In a special campaign with bonus payments, it was even € 4,301 (+43 %). The additional revenue ~+1,000-1,300 € per vehicle was generated here through six months of subscription use.

- General trend: In almost all cases analyzed, the additional subscription income exceeded the loss in value of the vehicles. However, it is important that the costs of the subscription model (insurance, administration, possible higher wear and tear) are under control. Dealers report that subscriptions can be particularly lucrative for young used vehicles and one-day registrations. Subscription use generates an additional gross profit per vehicle per month - depending on the model, this can be several hundred euros per month, which can significantly exceed the one-off margin of a sale when calculated over the year.

Conclusion: A car dealership that markets vehicles via its own subscription platform in the interim can significantly increase the contribution margin per vehicle. Practical examples show additional gross profits of €1,000-2,000 (or ~30-50% more) per vehicle compared to immediate sales. In individual cases, it is even possible to double the margin. The prerequisites are a suitable vehicle (with low depreciation during the period of use) and efficient subscription management. Many dealers therefore see the subscription model as a welcome source of income to partially compensate for falling new vehicle margins and the weaker maintenance business.

6. Conversion-Rate von Auto-Abo-Kunden zu Leasing-/Kaufkunden

The conversion rate - i.e. the proportion of car subscription users who later switch to leasing or buying a vehicle - is closely monitored in the industry. Concrete published rates are rare, but there are indications that car subscriptions can bind new customers to brands who later become buyers.

- New customer acquisition through subscriptions: Initially, car subscriptions bring many new customer contacts for dealers and manufacturers. An example: 82% of the subscription customers of the Schneider car dealership group in Bavaria were not previously customers of the dealership. This high rate of new customers shows that subscriptions appeal to buyers who might not otherwise have visited the dealership. From the dealer's point of view, these are valuable leads - you gain customers who can be persuaded to lease or buy after the subscription phase.

- Initial experience: Some manufacturers have had positive experiences with conversion. Hardly any concrete figures have been mentioned publicly, but double-digit percentages have been mentioned in discussions at industry conferences. For example, a significant proportion of “Care by Volvo” subscribers are said to have either taken over the vehicle or leased/purchased a new Volvo vehicle at the end of the subscription period (although Volvo itself does not officially communicate this rate). Similarly, premium manufacturers report that subscriptions act as an extended test drive: for example, customers test an electric car with a subscription and then decide to buy or lease the same model.

- Abo als Funnel: Branchenanalysten sehen im Auto-Abo eine Einstiegsoption: Kunden, die ein Abo nutzen, sind offen für das Produkt Auto, scheuen aber (noch) die Langfristbindung. Ein Teil dieser Kunden wird im Anschluss konvertieren, sobald das passende Angebot oder genügend Vertrauen da ist. Genaue Conversion-Rates hängen vom Anbieter ab. Bei konzerneigenen Abos (etwa VW, BMW) dürfte die Überführung in Leasing/Kauf höher sein, da diese Abos gezielt als Kundenbindungsinstrument eingesetzt werden. Unabhängige Abo-Anbieter zielen hingegen auf Flexibilität und weniger auf spätere Verkäufe.

- Mood scenario: According to a recent survey, ~35% of Germans are generally interested in car subscriptions - so they see them as a possible form of use. However, subscriptions are not completely replacing traditional car purchases. Although many subscription customers enjoy the flexibility, they value having their own vehicle as soon as it makes financial or practical sense. This is precisely where conversion occurs: if a subscription user is convinced by a model and their life situation stabilizes, they are more likely to switch to leasing/purchasing. Some dealers report that 20-30% of subscription users purchase a vehicle from them in the following year - however, reliable average figures are still lacking.

Conclusion: Quantitative data on the conversion rate from subscription to purchase customers in Germany is still scarce. The general trend is that car subscriptions open up new customer groups (e.g. 82% new customers in the case of one dealer example), and some of these customers become loyal to the brand following the flexible subscription. Experts estimate that a substantial minority of subscription users (perhaps one in five to one in three) later switch to a leasing or purchase contract - depending on the offer and customer segment. The development of this conversion rate is being closely monitored by OEMs, as a high rate would underline the sustainability of the subscription model as a sales channel. Manufacturers such as Volvo, Mercedes and VW are already using subscriptions specifically to convince customers of their products and subsequently win them over as long-term buyers. Overall, car subscriptions are therefore not only an independent business model, but also a marketing tool to ultimately lead undecided customers to purchase or lease a vehicle.

Sources: VDA/DAT Report, CAR Institute (Prof. Dudenhöffer/Helena Wisbert), Center Automotive Research analyses, industry studies (McKinsey, Accenture, Berylls, Roland Berger), press reports (Handelsblatt, Automobilwoche, AUTOHAUS, Autogazette, Tagesschau, etc.), as well as studies and surveys mentioned.